23 Aug Concessional contributions to superannuation… What are they, and why should I care?!

“Concessional” contributions and “Salary sacrificing” are a couple of terms you might have heard before. They’ve probably popped up in conversation with friends and family, co-workers, or that acquaintance that catches you in a corner at parties and never shuts up about finance. If these have gone over your head, this article is perfect for you. Let’s start with:

Concessional Contributions (CCs)

CCs are contributions that are made to your super fund from your gross income; i.e. before any tax has been applied. The contributions are then taxed at 15% on entry in your fund. The advantage of CCs is that the contributed amount is not counted towards your taxable income because you are not actually earning this money personally.

There is an annual Concessional Contribution limit. As of 1 July, 2021, the CC cap has been increased to $27,500 per financial year. From 1 July 2017 to 1 July 2020, the cap was $25,000.

For anyone over 18 and earning more than $450 in a calendar month, your employer MUST pay you these contributions, referred to as Super Guarantee Contributions (SGC). As of 1 July 2021, the minimum rate is 10% of your salary or wages; and this will increase by 0.5% per year until it reaches 12% from 1 July 2025 going forwards. If you’re under 18, you need to be working more than 30 hours per week before you qualify for these payments. SGC counts towards your annual CC limit above, so you need to be conscious of your totals before making additional contributions in this manner.

You are allowed to make additional contributions to your super fund, above your employer’s SGC. There are a few ways that you are able to do this:

Salary Sacrificing (SS)

Salary Sacrificing is a form of Concessional Contribution, requiring the willingness* and assistance of your employer. SS is when you elect an amount of your gross salary or wages to be contributed to your super fund each pay period. As the elected amount is removed from your gross income, you will only be taxed on the remaining income.

For example: Billy’s gross income is $700 per week, so after tax, he receives a take-home pay of $637.87 per week. Billy wants to boost his retirement savings, so he and his employer agree to Salary Sacrifice $50 per week. This money will be contributed to his super fund going forwards.

Billy’s gross income is now $650 per week, so after tax, he receives a take-home pay of $598.37 per week.

Even though he is sacrificing $50 per week, he is only losing $39.50 from his weekly take-home pay.

Billy will also pay 15% tax on the $50 per week as it enters the super fund, which is $7.50 per week.

*while most employers are happy to assist, they can refuse your request as it is not a legal requirement for them to accept.

Personal Concessional Contribution(s)

You are able to make concessional contributions to your super fund from your take-home pay and/or your savings. This is similar to Salary Sacrificing, but the tax benefits are essentially delayed until you have completed your tax return. You can make these contributions any time in a financial year, as long as you:

- Remain under your concessional contribution limit;

- The contribution is received by your super fund before the end of financial year; and

- Complete a Notice of Intent to Claim or Vary a Deduction for Personal Super Contributions with your super fund (before you submit your income tax return).

For example: Jess has a salary of $50,000 and she does not Salary Sacrifice. We would reasonably expect her to have paid approx. $6,717 income tax through the financial year.

Jess decides she wants to add to her super, and transfers $5,000 from her savings to her super fund. Once she sees the contribution in her super account balance, she completes a Notice of Intent with her fund, and the fund sends her a confirmation letter.

At tax time, she provides the confirmation letter to her accountant, and her assessable income is reduced to $45,000. The approx. income tax for an income of $45,000 is $5,092. Jess has already paid approx. $6,717. We would therefore reasonably expect her to receive a refund of $1,625 without considering any other factors.

Jess will also pay 15% tax on the $5,000 as it enters the super fund, which is $750. Therefore, by paying $750 tax (in super) and receiving a personal refund of $1,625, Jess is advantaged $875 which would otherwise be paid to the taxman.

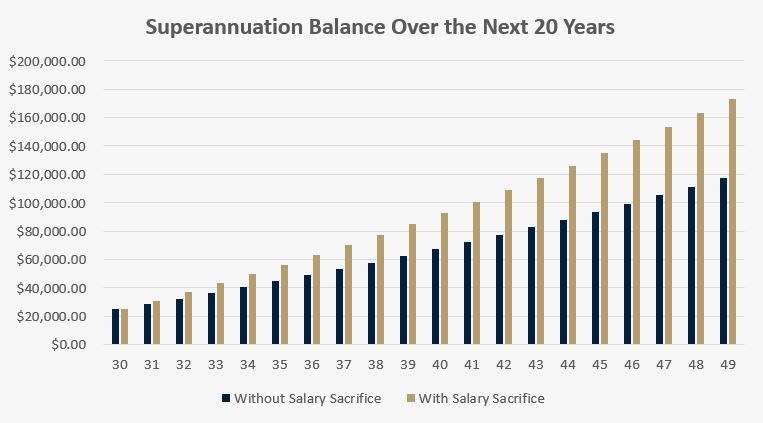

Okay, so what does all this mean for you? I’ve discussed the importance of building wealth through superannuation compared to doing so personally, in my article here. But below I’ve taken a look at the difference some extra contributions can make over a longer period. Remembering that investment returns will compound over time, let’s have a look at Billy’s scenario above. Let’s assume that Billy is 30 and has a starting super fund balance of $25,000, earning an average net return of 5% per annum. Over the next 20 years he continually Salary Sacrifices $50 per week:

In the chart above, we can see a considerable difference in Billy’s super savings over this period of time. In actual figures, by Salary Sacrificing Billy could have $173,172 instead of $117,664 by doing nothing.

Concessional Contributions and Salary Sacrificing may not be advantageous to everyone, and so careful consideration and planning is needed before implementing anything. Send an enquiry today and arrange a meeting to see how you could benefit from a well-structured financial strategy. Small changes now could make a lot of difference in the future.

Disclaimer: care has been taken in calculating the figures above, taken from taxcalc.com.au. However, this article is for demonstration purposes only. These figures exclude the Medicare Levy, and other factors and deductions which may otherwise cause differing outcomes to what is noted above. While a general advice warning has already been provided, I repeat that you cannot rely on these figures for your own personal situation, and should seek formal advice before making any decisions.

This article was written by Lochlan Stuhne-Scott, Authorised Representative (AR) of Leo Wealth, which is a Corporate Authorised Representative (CAR) of HNW Planning.