29 Aug Why superannuation is super important! (Especially in early adulthood)

When I’m going through an initial fact-finding meeting, most people have a tendency of not even knowing who their super account is with, let alone what their balance is up to. It’s seen as just an account that gets added to occasionally by your employer, and you can’t access it until you’re at least 60 so it isn’t very exciting, right?

Wrong! It is probably the most largely ignored secret accumulation of wealth that a lot of people have in their younger life. According to a number of sources (ASFA via AMP[1], ASFA via ANZ[2], News.com.au[3]) the average person accumulates around $23,000 to $28,000 before the age of 30. This is also likely going to increase as the rate of minimum employer Super Guarantee Contributions (SGC) increases to 12% by 2025. There is also legislation expected to be passed and apply from 1 July 2022, removing the current $450 per month minimum income threshold in order to receive SGC.

If I told you that you had $25,000 to invest, wouldn’t that interest you? While you might not be able to access this yourself right now, this balance is likely going to form a major part of your retirement capital at some stage in the future. A major advantage of superannuation is that investment returns are taxed at a low, flat rate of 15%. If we compared this to someone who is investing outside of the super environment, they could have a marginal tax rate of anywhere up to 45% (plus Medicare Levy).

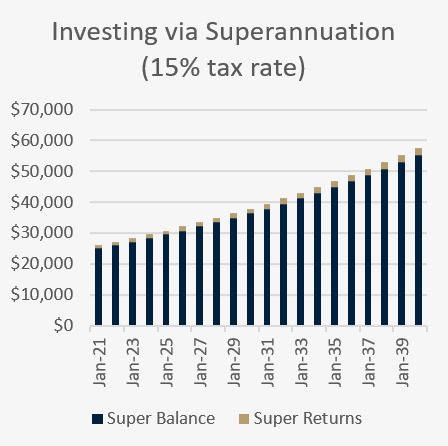

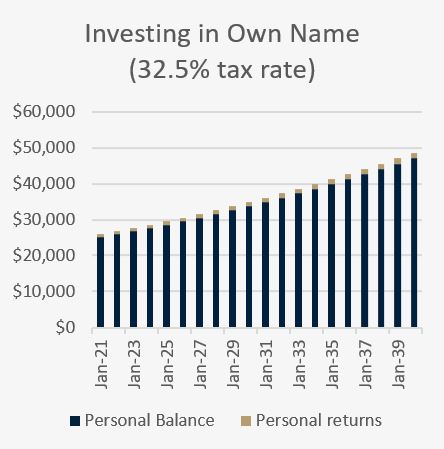

I’ve used the below chart examples to display the potential difference between investing via your superannuation versus in your own name. For the purpose of demonstration, I have assumed an initial investment of $25,000, growing at 5% per annum, over the course of 20 years. The superannuation chart is taxed at 15%, and the remaining returns are added to the next year’s initial balance in the 1st chart. The personal investment chart is taxed at 32.5%, and the remaining returns added to the next year’s initial balance in the 2nd chart.

As you can see from the above, there is a significant difference in outcomes as a result of the different tax rates. In this scenario, the super balance would have grown from $25,000 to $57,473 over 20 years, and represents a total net return of 130%. Over the same period, the personal balance would have grown from $25,000 to $48,557, representing a total net return of 94%.

By paying more than double the rate of tax investing in your own name compared to in superannuation, there is a 36% difference in outcome based on the above scenario. If we increased the average returns and added contributions to the mix as well, the difference in outcomes would be amplified further. And similarly, if we increased the rate of tax in the personal investment, the difference would be even further spread apart, as the net returns in the 2nd chart would be reduced.

Important note: investment returns and rates of return are not guaranteed. It is also highly improbable that rates of return would remain stable, as they will fluctuate year to year. The above was used purely to demonstrate a difference in outcomes based on tax payable. It ignores any other fees associated with investing such as platform administration and advice fees.

In considering how you can boost your superannuation balance further, you can see my article discussing different types of concessional contributions to super here.

Taking notice of your superannuation early is not only beneficial by taking more control, but it also develops one’s interest in investing and outcomes. This knowledge will be applicable across many aspects of your life, and provides you with a base level of education for establishing a personal investment portfolio at some stage too.

It is also worth pointing out that when you do retire and move your superannuation to ‘pension phase’ (subject to the Transfer Balance Cap and legislation at that time), your balance will move into a zero-tax environment. Your withdrawals from your pension phase balance are also tax-free. By having a strong superannuation balance established, you reduce the reliance on growth and portfolio returns to provide you with an adequate income in retirement.

Making small changes now can make a huge difference over time, and puts less stress on you in later life. It’s important to have a well-developed strategy for creating wealth both inside and outside of superannuation. Enquire today about how you can start to make the changes you need to create a financially secure future.

This article was written by Lochlan Stuhne-Scott, Authorised Representative (AR) of Leo Wealth, which is a Corporate Authorised Representative (CAR) of HNW Planning.

Articles referenced:

[1] https://www.amp.com.au/superannuation/super-basics/how-much-super-should-i-have-at-my-age

[2] https://www.anz.com.au/personal/investing-super/superannuation/super-guides/millennials-this-is-the-average-super-balance-for-your-age/

[3] https://www.news.com.au/finance/economy/australian-economy/how-much-money-should-you-have-in-your-superannuation-by-age/news-story/9b49907a8c9ad90137a6a7c4af54471d