27 Oct Real Estate Investing: 3 Benefits of Investing in a Property

Investing in real estate may seem quite complex and daunting to begin with. However, once you understand the benefits of investing in real estate, you may want to start looking further into how you can get started.

It’s common for those who begin investing in real estate to see the advantages not long after. One that excites people, is the opportunity to gain overall financial stability and financial freedom at an earlier age than they could ever have expected.

If you are able to choose your assets wisely, you may have the potential of enjoying predictable cash flow, excellent returns, tax advantages, and diversification.

But again, like any financial goal, investing in property requires planning ahead and research. While it takes time, it can pay well in the long run.

Let’s take a further look into the benefits of investing in property:

1. A Sustainable Income

With rising house prices and a growing population, an investment property could be beneficial to provide a reliable, sustainable income.

Investing your money in real estate doesn’t mean you have to constantly buy, renovate, and sell either. You could choose to rent out properties you purchase and get the benefit of maintaining a sustainable income for a number of years.

Choosing to invest in real estate and opting to rent the property out, can be ideal as it often provides a continuous cash flow without the constant hassle of renovating and maintaining a home.

The money you earn from renting a property could potentially be used for you to put towards your own mortgage, towards your retirement nest egg, or even a bigger investment portfolio.

With rising house prices, more and more Australians are seeking a great rental property which they can call home.

As the Australian Institute of Health and Welfare sees a decline in homeownership trend in the past years and an increase of renters, we can expect rental properties to remain a popular investment choice.

Therefore, the rent you’re asking from your tenants right now might even balloon to a more significant value in the next few years.

2. A Booming Industry

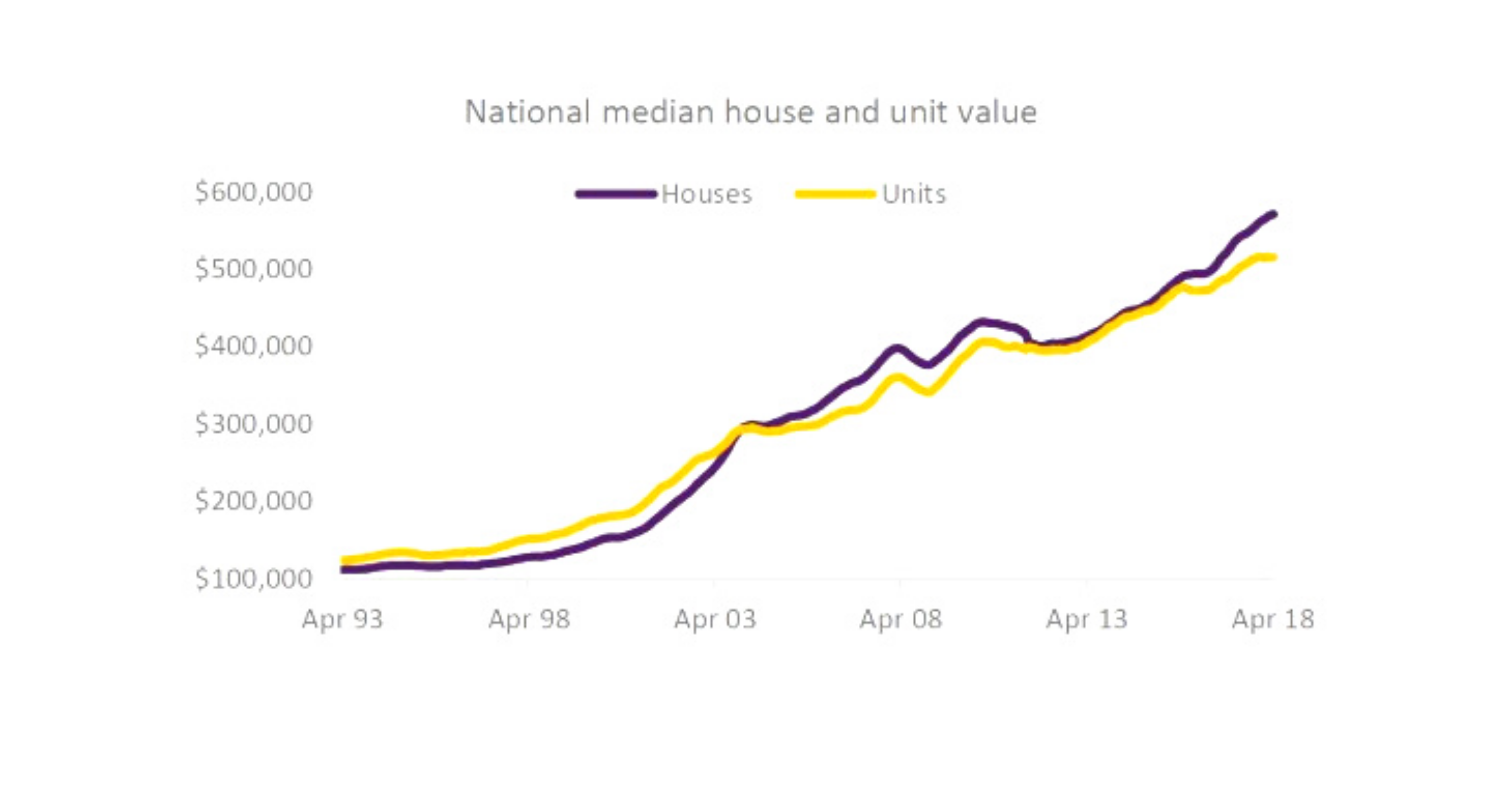

The housing market has shown extraordinary growth over the past 25 years, moving through five distinct growth cycles which have pushed national median house values by at least 412%.

A great property to invest in is determined by:

- Location

- Kind of home

- Size

With careful selection, you could be looking at great sustainable returns over the long-term.

Plus, property investors can outperform the average returns by researching areas of solid capital growth and buying properties below market value. This way, the property’s value increases over time and you can benefit from capital growth and rental return.

3. Opportunities to Gain High Returns In Time

Investing in most things is considered a risk by many. Since prices, demands and returns always change over time, people can think of investments as taking a chance at times, where you give a lot without knowing which things you can win in return.

However, investing in properties with expert financial guidance can provide an incredible opportunity.

Like any other investment, house prices fluctuate over time but in general, property prices have increased favourably.

Source: Corelogic from Aussie Property¹

Through a bit of improvement and added value, a house you buy at a low rate may sell at a value higher than you expect down the line.

Investing in real estate is a great option for those willing to put their extra money into something that can grow in time. Spending your income on properties just may be your ticket to retiring early and gaining financial freedom at an earlier age than you expected.

Leo Wealth is a financial planning company on the Central Coast helping people make the right investment choices, with the capacity to provide specific property advice.

We believe that financial advice is not only about investing or growing your money. Instead, it is also about how people can maximise their current situation to provide financial freedom for themselves and their families.

Talk to us today and schedule an appointment!

REFERENCES

1 https://www.aussie.com.au/plan-compare/property-reports/25-years-of-housing-trends-property-market-report.html