17 Sep CASE STUDY: Using the First Home Super Saver Scheme

Using the First Home Super Saver Scheme we’ve added almost $5,000 a year to Jack and Sally’s savings, and without making any changes to their budget.

Background:

In the 2017-18 Federal Budget, the government introduced the First Home Super Saver Scheme (FHSSS) to assist first home buyers with saving for a home deposit. While you can find further information about this scheme from the ATO here, a very simple summary is: that a person seeking to purchase their first home can utilise contributions to superannuation (above their employer super guarantee contributions) as a part of their home deposit. There are annual limits for how much can be contributed, and a maximum limit on how much can be withdrawn, as well as taxation that needs to be considered. But the main takeaway is: you can use additional concessional and non-concessional contributions to super to accelerate your savings for your first home.

It’s important to reiterate here that this scheme is for your first home purchase only (in that you would otherwise meet the conditions to receive the First Home Owner Grant). It is not for the purchase of an investment property, and once you have owned direct property previously, you are no longer eligible for the FHSSS or the above grant. If one partner in a couple has previously owned property, neither will be eligible for the First Home Owner Grant, BUT the non-property-owner may still be able to utilise the FHSSS.

Case:

I met with Jack and Sally towards the end of May. While they have been generally saving for some time longer, over the last 18 months they have cut back on their lifestyle to focus on saving for their first home. Neither have owned a property before, and they intend on moving into the property they purchase as their main residence. Together, they have saved $100,000 which is sitting in a cash account returning 0.30% per annum. Other than having a well-planned budget, they are unsure of what else they can do to accelerate their savings.

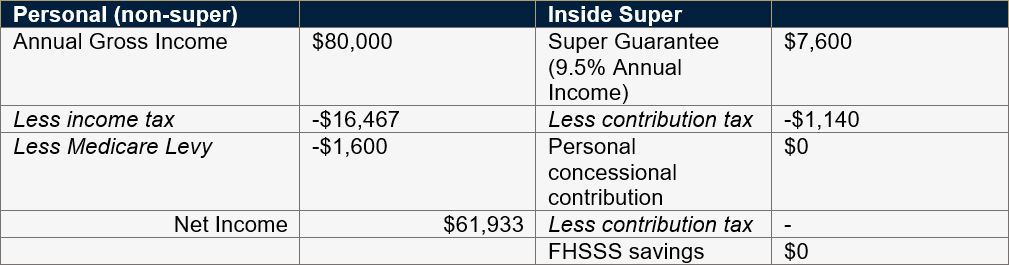

They are both individually earning an annual income of $80,000, and aren’t carrying any student loan debt. Using MoneySmart, we would reasonably estimate that they will each have paid $16,467 income tax, and $1,600 Medicare Levy in the full financial year; total tax of $18,067.

Based on their commitment to saving for a first home, and not an investment property, I presented using the FHSSS as part of a strategy to accelerate their savings. They could use personal concessional contributions (CCs) to super (I’ve written more about CCs here) to reduce their total tax payable, and save the excess. Here’s some notes before I tell you what we did:

- Concessional contributions can be made to super, which are then taxed at 15% instead of your marginal tax rate (which is 32.5% for Jack and Sally). In doing so, the amount contributed is also reduced from your taxable income when submitting your tax return.

- The FHSSS allows you to make up to $15,000 in gross contributions (regardless of type) to super per financial year, that can be used in the scheme.

- Jack and Sally have not made any contributions to super (outside of their employer’s contributions) and have been paying full tax on their fortnightly income.

- They are happy to commit their funds, understanding that if they do not end up purchasing a home, they will not be able to withdraw this money again until retirement (or other condition of release).

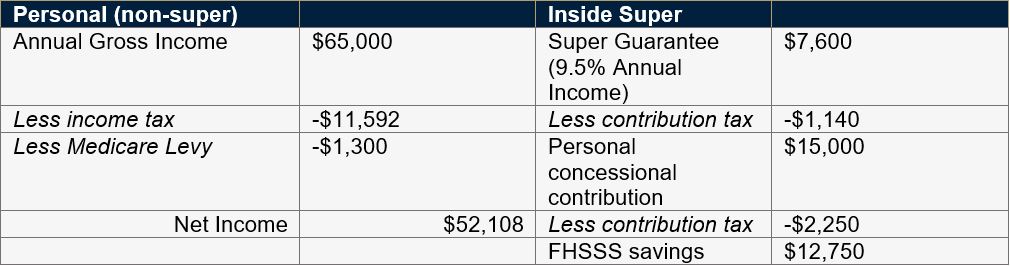

Because Jack and Sally have $100,000 savings already sitting there, and not doing anything else, we decided to contribute the maximum under FHSSS before the end of financial year. We made a concessional contribution of $15,000 to each of their super fund accounts. By doing so, we were charged 15% tax on the contributions, but we reduced their taxable incomes to $65,000. Here’s how this looked:

As they are (pre-advice):

Estimated position (post-advice):

Now, instead of total personal (non-super) tax of $18,067 each, we have reduced their total estimated tax to $12,892 each. That is $5,175 less than they would have been expected to pay for a full year’s wages. Without taking any other tax deductions or factors into account, we therefore expect that Jack and Sally will both receive $5,175 in their tax return, as a refund for over-paying in tax.

It is important to remember that we have increased the tax payable inside each of their super funds by $2,250. AND (assuming their incomes remain the same) there will also be 34.5% less a 30% tax rebate on any amounts they withdraw using FHSSS. 4.5% of $12,750 is $573.75. So the total increase in tax in super is $2,823.75.

Summary:

When considering Jack and Sally together, we have saved them $10,350.00 in personal tax, and increased their tax in super by $5,647.50. So that is a total net benefit of $4,702.50 that they will have in their pockets, which would otherwise have been paid to the tax man. These extra funds can now be added to their home deposit savings.

Some risks to consider:

- When making personal contributions to superannuation, they will initially be allocated as non-concessional contributions, for which there is no tax benefit. You need to complete a form with your fund to reallocate these as concessional to receive the above benefits.

- Any refund of tax from making concessional contributions will only be paid after the completion of your individual tax returns. Therefore, you need to consider time of year and when you intend to make your purchase prior to making these contributions.

- Tax refunds will vary depending on your own situation, and other factors such as HECS or FEE-HELP student debt.

- When attempting to withdraw the FHSSS deposit from your super, any debt to the ATO will be paid before the remainder is paid to you. Therefore, you need to have paid any outstanding tax from your return first, or request the withdrawal prior to submitting your income tax return.

The above are only some of the risks associated with this strategy. This is why it is vital to speak to a professional, who will take your individual circumstances into account, and create a plan around you. Get in contact for a complimentary initial consultation and see how we can tailor your strategy to boost your first home savings!

This article was written by Lochlan Stuhne-Scott, Authorised Representative (AR) of Leo Wealth, which is a Corporate Authorised Representative (CAR) of HNW Planning.