18 Nov What You Need to Know About Superannuation for a Comfortable Retirement

Superannuation is an important tool for every Australian. Even as a young person, it is highly recommended that you start saving for your retirement as early as possible. This way, you won’t have to stress about money in the future as you try to reach your financial goals. Plus, the earlier you start, the more time your retirement savings have to grow.

Many people refer to their superannuation as “savings for retirement”. But actually, it is more accurate to label your super as an investment for your retirement. This is because your super fund invests the money on your behalf so that it grows in your account.

Either way, your super is a way you can fund your retirement and live the happy and comfortable lifestyle you deserve.

In this article, we’ll delve deeper into superannuation, talking about how exactly it is paid, how much you may need to retire comfortably, and more.

As a financial advisor on the Central Coast specialising in retirement planning, I often get asked many similar questions around superannuation and how it can be used best. So I thought I would answer the most frequently asked questions I receive so you can take the first steps towards your dream golden years:

How much does my Employer pay to my Superannuation Fund?

Employers in Australia have to pay their employees a Superannuation Guarantee. Currently, that amount is 10% of your ordinary time earnings (ie. your salary).

However, the good news for Australian workers is that the Superannuation Guarantee will rise each year until it reaches 12% in 2025.

While this small percentage change may not seem like a lot, it could make a huge difference to your super balance and go towards funding your dream retirement.

When Can I Access My Super?

A superannuation fund is meant to only be accessible for retirement unless under certain circumstances. Only once an employee meets certain conditions can they access the superannuation fund.

These conditions include:

- Reaching the age of 65 regardless of whether they are retired

- Reaching the preservation age and retiring, or

- Under the transition to retirement phase if you are still working.

There is another way you can access your superannuation. If you are a first home buyer, you can use the first home super saver scheme.

Can I add to my Superannuation Fund?

Absolutely.

If an employee feels like the amount paid to the superannuation fund isn’t enough to fully fund their retirement, they have the freedom to add more to their fund. In fact, many experts recommend making personal superannuation contributions to achieve retirement goals quicker.

This is because many Australians’ super balance is not on track for a comfortable retirement.

The Association of Superannuation Funds of Australia (ASFA) estimates that an individual will need around $44,000 per year to secure a comfortable retirement lifestyle. For a 20 year retirement, this means a total retirement budget of $880,000.

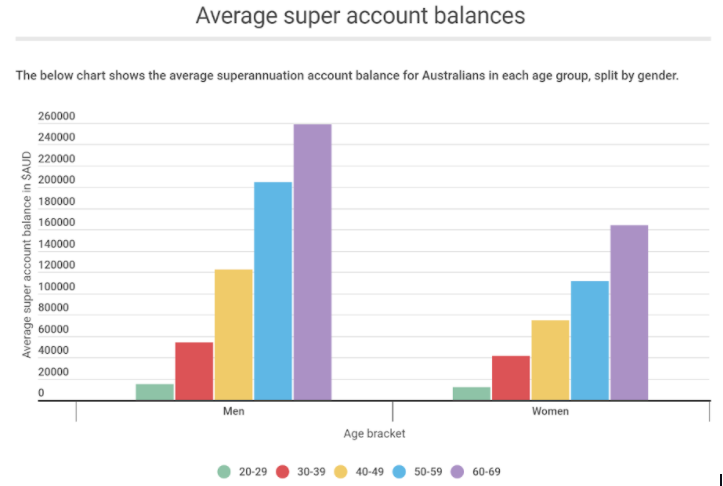

But as you can see below, the average super balance is nowhere near that amount for both men and women.

*Data according to ASFA statistics for average super account balances in the 2015-16 financial year.

*Data according to ASFA statistics for average super account balances in the 2015-16 financial year.

If you’re wanting to grow your super balance before retiring, here are some strategies you can consider:

- Salary sacrificing (ie. before-tax super contributions)

- Making extra contributions (ie. after-tax super contributions)

- Changing your super investment option

If you’re thinking of adding extra money to your super fund, how much is the right amount to contribute? Check out our article for my in-depth super contribution guide.

All in all, if you are an Australian working in the country, you will more than likely have superannuation contributions from your employer.

That said, relying on those contributions alone may not be enough. If you are planning for retirement, it pays off to have a good understanding of your superannuation options. You may just secure your perfect, comfortable retirement through your superannuation.

Financial Advice on the Central Coast

If you want personalised superannuation advice or retirement planning services, reach out to Leo Wealth Financial Planning.

We can help you understand the numbers you need to hit and can help you craft a plan to meet set goals to live a happy retired life.

At Leo Wealth, our expert financial advisor in the Central Coast offers clients the assistance needed to plan a financially secure and healthy future.

Reach out to us today and let us help with your retirement plan!